We’ve all heard of Uber. Perhaps you’ve even used the ride sharing company, recently declared to be worth $50 billion (that’s billion with a ‘b’). But what is it really like to be a driver using the Uber system? In my experience, it’s a risky job in terms of financial risk and wage earning.

I’ll spare you the backstory on Uber’s controversial entry into the Portland Oregon market, but know that they have made few friends in this town. Unlike the Taxi business they are helping independent contractors to compete with, Uber is not a transportation service. They are a technology company providing independent contractors (the drivers) the tools to be a driver and setting rates on their behalf. Of course, not everyone agrees that the contractor-technology provider is their actual business model. For sake of argument, however, I’m going to assume that they are legitimately the technology company they claim to be.

I made the decision to try out being an Uber driver for 2 days. I was curious how this business model could bring me extra money. What I discovered in the 5 hours across two days that I was in my car, on the road and away from my family sealed the deal: The gig simply doesn’t work for me.

What follows is my own personal experience. I don’t claim be a representative case study of ALL ridesharing drivers. I’m also not picking on Uber in particular – Lyft and others have a strikingly similar business model that falls apart for the same reasons for me.

The Agreement

Before you can ‘go online’ (i.e. be available to pickup fare requests), you must put some time and effort in. Personally, the following list took me about 2 hours of labor in my off hours – a fairly easy and low cost set of startup costs:

- Pass a background check (takes 3-7 days)

- Have my vehicle inspected (1 hour)

- Send a photo of my Drivers License to Uber (5 minutes)

- Send a photo of my vehicle registration to Uber (5 minutes)

- Send a photo of my personal insurance to Uber (5 minutes)

- Register for a Business License in the City of Portland (20 minutes)

- Send a photo of the Business License to Uber (5 minutes)

- Meet requirements to operate in the city (20 minutes – the fire extinguisher and first aid kit were given to me no charge at my vehicle inspection)

As long as everything checks out, you’ll get the green light to drive in about 3 days.

Sort of.

After you get the ‘Congratulations! You passed!’ text message, there’s still the 19 page agreement you should read and understand as well as the service fee schedule that you also should read and understand. Curiously, you don’t get these two critical documents until you’ve gone to all the hassle of passing the Uber tests.

I suspect it’s at this point that most people don’t read the agreement or fee schedule and just start driving. The excitement overcomes them and they want to start driving right away. Any time an agreement is set before you and lots is at stake, it’s always best practice to read and understand terms before taking advantage of that agreement.

There is a a huge amount you are committing to as a driver. You’re agreeing that you’re not an employee, that you won’t say anything disparaging about Uber or its affiliates, that you’ll drive safely and arbitrate if there are disagreements. You’re agreeing to be cut off from the service at Uber’s discretion and that you’ll let Uber track you in your 2005 or newer car that’s in perfect mechanical condition – or else.

That’s the tip of the iceburg. The whole thing is here. You should read it.

The Insurance

Your personal automobile insurance will most likely not cover you while you’re doing any business for Uber – including driving to your fare’s pickup spot (known as the ride-sharing insurance gap). For the most part, however, Uber has insurance (with a $1,000 deductible) to cover you. The risk that you run is that you may get dropped by your insurance if you do have an accident that Uber covers.

While no precedent has been established yet, there isn’t anything preventing an insurance company from dropping you partially or entirely simply learning that you are currently or have driven for Uber.

The good news is that there are insurance options coming online to cover the ‘gap’. Insurers such as metromile are offering drivers in Oregon coverage now.

The Riders

I picked up a total of 5 fares during my 5 hour stint as a driver. All of them were during the day at afternoon rush hour. I suspect by virtue of this, I avoided the dreaded puking uber rider in my car.

All 5 of my fares were incredibly interesting, clean and appreciative. This was in fact the highlight of my experiment. I had the pleasure of driving around an economist from eBay, a marketing consultant, a business consultant, a group of medical professionals and a professional researcher. All were male, between 25 and 40.

The Money

How you get paid

The reason anyone gets behind the wheel for Uber, Lyft or any other ridesharing company is to make money. It’s not because people want to ‘help out in their community’. If that were the case, we would be volunteering for a cause – not driving relatively wealthy people around for fares.

Uber’s fares and how they pay you is fairly simple. Take the amount your rider pays and you get 80% of it. The rider pays a fare that consists of per-mile charge and per-minute charges in addition to various fees. At the end of every week, you get a direct deposit for the fares you are due. Uber does all the paperwork and sets the rates.

What you earn with the flag down

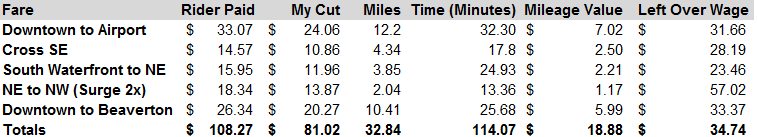

Keep in mind that you are only paid when ‘the flag is down’ – i.e. you have someone in your car and you are transporting them. So, you’re making money if you’re going from fare to fare to fare and aren’t having to drive ‘off the clock’. Here’s what my earnings broke down into:

I averaged a pre-tax wage of $34.94 while the flag was down. This number represents the deduction of the value of the miles driven for the fare at $0.575/mile. I even had one fare that was charged to the rider at 2x surge pricing for the fare that worked out to $57.02/hr. Too bad that ride was only 13 minutes long.

I averaged a pre-tax wage of $34.94 while the flag was down. This number represents the deduction of the value of the miles driven for the fare at $0.575/mile. I even had one fare that was charged to the rider at 2x surge pricing for the fare that worked out to $57.02/hr. Too bad that ride was only 13 minutes long.

Cost of your Vehicle

Anyone who’s worked for a respectable employer and has used their vehicle for work purposes has been reimbursed for mileage on their personal vehicle in addition to their normal wage knows that the IRS has set rules on what your miles are worth. At present, it’s $0.575/mile.

This number covers your personal expenses for owning and operating your personal vehicle for business purposes. Specifically:

The costs that are contemplated by the standard mileage rate are standard maintenance, repairs, taxes, gas, insurance, and registration fees.

When you go to do your business accounting paperwork, you will be reimbursing yourself personally for the miles on your personal vehicle. Failure to do so is wasting money. The mileage reimbursement is tax free – wages are not. You should pay yourself the mileage reimbursement before you consider how much is left to pay yourself for wages.

Unless you purchase your vehicle as a business expense, title it under the business name and pay all the costs directly as a business, your vehicle is considered personal. You will only be allowed to reimburse yourself $0.575/mile for business use. You cannot write off your actual fuel, personal insurance, maintenance, taxes or registration costs.

If you have a cheap and reliable car, this arrangement is going to actually be a money maker – particularly if you don’t rely on that vehicle for personal use. But that’s not the portrait of the average Uber driver. Uber drivers are driving very nice cars (2005 or newer model year is required) that they own and use personally when they aren’t ferrying around riders.

Keep in mind that high mileage cars fetch thousands less on the used car market. Also consider that the direct costs for maintaining a high mileage vehicle are very high as well and will ultimately come out of your pocket before you are ever reimbursed for it.

What you (don’t) earn with the flag up

As an independent contractor, you are running a business. The difference between your business and larger businesses is that you are not diversified and staffed up to take a loss. Ask any Taxi driver and they will tell you – when the flag is up, they are losing money. The same is true for ridesharing drivers, too.

You earn nothing when the flag is up.

This is where you are going to get into trouble if you believe that you can make $34.94 an hour. Your total earnings are:

Income – Expenses = Profit

At the very least, your expenses include mileage reimbursements to yourself. Commonly, it will also include things like car washes, meals, bottled water for your riders and your personal time to maintain the vehicle.

You don’t stop incurring expenses when the flag is up.

All the time you spend ‘online’ waiting for a fare is at your own expense (and as we learned earlier, it can be entirely at your own risk without the right insurance coverage).

Your time spent on the following are not paid to you in any way by Uber:

- Driving to pickup a fare

- Waiting for a fare to arrive

- Driving home or to a new pickup zone after dropping off a fare

- Driving around and waiting for the next fare to come in

This means you absorb the costs above – they come straight out of your profit.

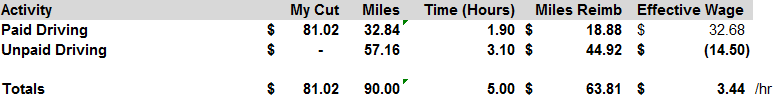

In my 5 hours, I drove more miles off the clock than on the clock. In fact, I spent 3 hours (61% of my time) with the flag up, in one of the situations listed above. I was doing business, not being paid.

The business entity you created to do this gig is going to need to pay you personally back at that mileage rate for the use of your personal car to do business. This includes not only the miles that you spend on a fare, but also the miles you spend ‘doing business’. A mileage reimbursement is almost always not income. Do not be tempted to think of it as income.

So, if you take into account the total time spent, miles driven, reimbursement back to myself for the miles and amount earned from Uber, here’s what it looks like:

Yes, you read that right. I earned a whopping $3.44/hr before taxes. Keep in mind that I have only deducted the expense of the standard mileage reimbursement from my business’s payout from Uber. I haven’t included other expenses such as the car wash I paid for, the pack of gum I picked up or the dashcam I purchased (for safety). If I include those, the number goes down more.

Why is it so expensive when the flag is up?

The fact of the matter is, you can find yourself not taking fares when you’re trying to pick them up or trying to get home after dropping the last fare off. In my experience, I found the following contributed to the significant amount of time and miles I spent with the flag up:

- Driving back. Fares that take you a long way out require that you drive back. If this happens to be at the end of the day, you’re not going back ‘online’ and risk being late for dinner. You should consider your time to drive back home from a client drop off as business miles.

- Traffic. Traffic is awful at peak hours. Much of my time was spent in parking lot traffic due to accidents and congestion. If you have a fare, you’re getting $0.24/minute to sit there (that’s $14.40/hr) to sit there with someone in your backseat, burning fuel you’re not getting reimbursed for since you’re stuck in a standstill parking lot.

- Waiting for a fare. Unless you start your time in a busy area, you aren’t likely to pick up a fare right away. Uber encourages drivers to drive to busy areas to pickup fares by offering ‘surge‘ pricing that comes and goes as demand fluctuates. If you try to follow the surge pricing or busy areas, you’re spending your own money on miles and time in hopes of getting a surge fare.

- Potty and Food Breaks. Finding a bathroom when you’re nowhere from home and in the sticks after dropping off a fare cut into my time as well. So did the need to stop and get some trail mix from a quick-e mart.

What’s the value of your time and miles?

Drivers must consider a fairly complicated financial picture to see if Uber works for you or not. It’s not for everyone. I personally bill out to clients at my day-job at a rate of $150/hr. Taking $4.33/hr plus mileage reimbursements is slapping myself in the face. It’s not Uber’s fault. They set the rates and you agree to drive them and follow their rules. Consider all angles before you start hoping for a huge payout.

Ride-sharing as a novel concept with deep roots in the core values of the sharing economy that is taking shape across the U.S. In many ways, it’s a promising model with great potential to better society. The sharing economy makes services and products more accessible to more people by turning the single purpose mindset on its head. What it doesn’t yet do, however, is pass the actual costs of the ride through to the riders. The driver runs the risk of bearing of a significant portion of actual expenses and taking on heightened risk and repercussions from insurance coverage and accident events.

For me, the money and risk did not make up for the time I spent doing it and the wear and tear I put on our nicest car was not a pattern I wanted to establish.

Sorry Uber. I wont be flashing the trade dress on my front window any more.

Leave a Reply